Why can’t tech fix its gender problem?

A full decade has passed since Ellen Pao filed a sexual discrimination suit against her employer, the legendary Silicon Valley venture capital firm Kleiner Perkins. Two years later came the toxicity and misogyny of Gamergate, followed by #MeToo scandals and further revelations of powerful tech-business men behaving very badly. All catalyzed an overdue public reckoning over the industry’s endemic sexism, racism, and lack of representation at the top. And to what effect?

Many slickly designed diversity reports and ten thousand Grace Hopper coffee mugs later, the most striking change has been in the size and wealth of the technology sector itself. Even as the market overall turned bearish in 2022, the combined market capitalization of the five largest tech companies approached $8 trillion. Despite the sector’s great wealth and loudly self-proclaimed corporate commitments to the rights of women, LGBTQ+ people, and racial minorities, tech remains mostly a straight, white man’s world. The proportion of women in technical roles at large companies is higher than it used to be but remains a painfully low 25%. Coding schools for people of marginalized genders are expanding, and the number of female majors in some top computer science programs has increased. Yet overall, representation remains low and attrition high, especially for women of color.

Much of the burden for changing the system has been placed on women themselves: they’re exhorted to learn to code, major in STEM, and become more self-assertive. In her 2013 bestseller Lean In, Sheryl Sandberg of Meta urged women to push harder and demand more—by acting the way men did.

Self-confidence and male-style swagger have not been enough to overcome structural hurdles, especially for tech workers who are also parents. Even the mass adoption of remote work in the covid-19 era failed to make tech workplaces more hospitable. A recent survey by Deloitte found that a majority of women in the industry felt more pessimistic about their career prospects than they did before the pandemic. Nearly six in 10 expected to change jobs as a result of inadequate life-work balance. More than 20% considered leaving tech altogether.

At Amazon, Apple, Google, and Microsoft, the CEO baton has passed from one man to another. Sandberg announced in June that she was stepping down, Elizabeth Holmes awaits criminal sentencing for fraud as CEO of Theranos, and the #girlboss moment has given way to swaggering performances of tech-mogul masculinity such as Jeff Bezos, in spacesuit and cowboy hat, soaring skyward in a phallic rocket.

After the US Supreme Court decision overturning Roe v. Wade, large tech companies were among the first to announce that they would cover the costs for employees who needed to travel to another state to end a pregnancy. But they refrained from taking positions on the ruling itself. Meta discouraged employees from talking about it on company message boards, even limiting the visibility of social media posts by Sandberg lamenting the decision. Support for abortion rights and the women advocating for it only went so far.

Much of tech’s gender problem is a corporate America problem. Women, especially women of color, remain grossly underrepresented in top executive ranks across sectors. But tech is an industry that promised to think different, change the world, and make money without being evil. It also has a long history of employing many technical women.

Software programming once was an almost entirely female profession. As recently as 1980, women held 70% of the programming jobs in Silicon Valley. That ratio has completely flipped. Female technicians once outnumbered male workers on the Valley’s hardware assembly lines by more than two to one. Those jobs are now nearly all overseas. In 1986, 36% of those receiving bachelor’s degrees in computer science were women. The proportion of women never reached that level again.

Many things contributed to the shift: the educational pipeline, the tech-geek stereotypes, the industry’s long-standing and enthusiastic reliance on hiring by employee referral, the tiresomely persistent fiction of tech as a gender-blind “meritocracy.” None explain it entirely.

What really lies at the core of tech’s gender problem is money.

The technology industry has generated significant, and sometimes enormous, personal fortunes. Most of this money has gone to men. Tech executives have become the richest people in human history. Only two women currently appear on the list of tech’s 20 richest people: one is a widow of a male tech billionaire, the other an ex-wife of one.

Venture capital investment has been and remains the tech ecosystem’s least diverse domain. White and Asian men make up 78% of those responsible for investing decisions and manage 93% of venture dollars overall. While there are now more female-led investment funds than there were a few years ago, the majority of venture capital firms still have zero women as general partners or fund managers.

Of the few women in these roles, nearly all are white. The US venture capital industry invested a record-breaking $329 billion across more than 17,000 deals in 2021. Only 2% of this bonanza went to startups founded solely by women—the lowest level since 2016. Less than 0.004% of the venture capital invested in the first half of 2021 went to startups with Black female founders.

The lack of investor and founder diversity has far-reaching consequences. It does not only determine who gets rich. It also shapes the kinds of problems technology companies set out to solve, the products they develop, and the markets they serve.

The patterns seen today in venture capital firms have been more than seven decades in the making. That is one reason they are so difficult to unwind. But there’s another, thornier problem. The things that have worked against venture diversity—and tech diversity in general—have also been secrets of the American technology industry’s success since the very start.

Beginnings: “A future without boundaries”

There was never really a golden age for women in tech. If a job was female-dominated, it often paid less and was valued less, and its occupants were considered easily replaceable. When women did the same jobs as men, they were regarded as a curiosity, a blip in a male-dominated corporate world.

In 1935, IBM chief executive Thomas Watson Sr. made a great show of hiring 35 newly minted college graduates as his company’s first class of “Systems Service Women,” tasked with giving technical support to new customers. Men held these jobs too, but only the women spent their first week of employment being feted like debutantes, welcomed with bouquets of flowers and a formal dinner dance hosted by Watson.

The women who programmed wartime computer projects in the 1940s were first called “operators,” their jobs seemingly little different from those held by the thousands of fast-thinking women who sat before the nation’s telephone switchboards. With the arrival in the early 1950s of program compilers—a technology and term invented by a woman—the workers became “coders,” a word reflecting a persistent misunderstanding of programming as something mechanistic, practically stenographic.

Around the same time, IBM executives placed mainframes in the lobby of the company’s New York City headquarters and hired female programmers to work in view of passerby. That way, one supervisor explained to a female recruit, the machines “will look simple and men will buy them.”

Meanwhile, corporations aggressively recruited technical men, promising good paychecks and likely promotion. In the late 1950s and early 1960s, the gender-segregated classified employment pages brimmed with ads enticing male engineers through promises like “Your own enthusiasm and professional growth are the only limits to a future without boundaries.”

Early computing history abounds with these stories, reflecting the endemic sexism of American corporate culture before equal-opportunity laws and other victories of modern feminism. Notably, the women who rose to senior technical positions during this period often worked for military agencies or at NASA, where clearly codified standards for promotion better protected women from managerial whims.

Growth: “The Olympics of capitalism”

While technical women stayed mainly within large organizations, male engineers gradually began to leave academia and corporate life to start their own companies. This entrepreneurial model reached its apex in Northern California’s Santa Clara Valley.

Stanford University–trained engineers had been starting companies in local garages and disused farm buildings since the 1930s, but it wasn’t until the 1950s that the Valley became a tech powerhouse. Cold War spending transformed Stanford, filled the Valley with defense contractors, and fueled growth of a new cluster of silicon-semiconductor startups. The firms gave Silicon Valley its name, built many of its first great fortunes, and left an indelible imprint on its corporate culture.

Life in early Silicon Valley chip firms was like Mad Men with fewer suits, more all-nighters, and the occasional screaming match over circuit-board design. Secretaries were usually the only women in sight. Employees were expected to show up before 8 a.m., work as late as they could bear, and then go out for beers. The countercultural 1960s never really happened in the semiconductor industry; this was engineering, not an encounter group. Management rewarded rational minds and thick skins. “I hired you,” National Semiconductor executive Don Valentine once told a new recruit, “because you were the only one I couldn’t intimidate.”

Making all this intensity possible were stay-at-home wives—the most hidden of tech’s hidden figures, whose care of children and home allowed for their husbands’ total work immersion. The rare female executive had to keep pace, acting as if similarly unbothered by personal demands, sneaking phone calls to her children on the side.

By the 1970s, the success of these firms had minted hundreds of millionaires, most men in their early 30s. High-tech entrepreneurship, one Valley investor declared, was “the Olympics of capitalism.”

Not competing in this Olympics, but still contributing to the industry’s success, were the thousands of women who worked in the Valley’s microchip fabrication plants and other manufacturing facilities from the 1960s to the early 1980s. Some were working-class Asian- and Mexican-Americans whose mothers and grandmothers had worked in the orchards and fruit canneries of the prewar Valley. Others were recent migrants from the East and Midwest, white and often college educated, needing income and interested in technical work.

With few other technical jobs available to them in the Valley, women would work for less. The preponderance of women on the lines helped keep the region’s factory wages among the lowest in the country. Women continue to dominate high-tech assembly lines, though now most of the factories are located thousands of miles away. In 1970, one early American-owned Mexican production line employed 600 workers, nearly 90% of whom were female. Half a century later the pattern continued: in 2019, women made up 90% of the workforce in one enormous iPhone assembly plant in India. Female production workers make up 80% of the entire tech workforce of Vietnam.

Venture: “The Boys Club”

Chipmaking’s fiercely competitive and unusually demanding managerial culture proved to be highly influential, filtering down through the millionaires of the first semiconductor generation as they deployed their wealth and managerial experience in other companies. But venture capital was where semiconductor culture cast its longest shadow.

The Valley’s original venture capitalists were a tight-knit bunch, mostly young men managing older, much richer men’s money. At first there were so few of them that they’d book a table at a San Francisco restaurant, summoning founders to pitch everyone at once. So many opportunities were flowing it didn’t much matter if a deal went to someone else. Charter members like Silicon Valley venture capitalist Reid Dennis called it “The Group.” Other observers, like journalist John W. Wilson, called it “The Boys Club.”

The venture business was expanding by the early 1970s, even though down markets made it a terrible time to raise money. But the firms founded and led by semiconductor veterans during this period became industry-defining ones. Gene Kleiner left Fairchild Semiconductor to cofound Kleiner Perkins, whose long list of hits included Genentech, Sun Microsystems, AOL, Google, and Amazon. Master intimidator Don Valentine founded Sequoia Capital, making early-stage investments in Atari and Apple, and later in Cisco, Google, Instagram, Airbnb, and many others.

Generations: “Pattern recognition”

Silicon Valley venture capitalists left their mark not only by choosing whom to invest in, but by advising and shaping the business sensibility of those they funded. They were more than bankers. They were mentors, professors, and father figures to young, inexperienced men who often knew a lot about technology and nothing about how to start and grow a business.

“This model of one generation succeeding and then turning around to offer the next generation of entrepreneurs financial support and managerial expertise,” Silicon Valley historian Leslie Berlin writes, “is one of the most important and under-recognized secrets to Silicon Valley’s ongoing success.” Tech leaders agree with Berlin’s assessment. Apple cofounder Steve Jobs—who learned most of what he knew about business from the men of the semiconductor industry—likened it to passing a baton in a relay race.

Venture capitalists often believed that the person was as important as the product, if not more so. “An average idea in the hands of an able man,” declared Georges Doriot, the Harvard Business School professor known as “the Father of Venture Capital,” “is worth much more than an outstanding idea in the possession of a person with only average ability.”

One surefire way to find “able men” was to fund or recruit people you had successfully worked with before. This is another critical dimension of the Silicon Valley model: tightly knit networks that often work together in multiple startups. The most famous of these groups acquired nicknames. The men who left the Valley’s first silicon chipmaker, Shockley Semiconductor, to start Fairchild Semiconductor were called “the Traitorous Eight.” Four decades later, a group of men, many of whom had met writing for Stanford’s conservative student newspaper (including Peter Thiel, who cofounded it), became a core part of the founding team of PayPal. With the company’s acquisition, they became “the PayPal Mafia,” using their wealth to found new venture-backed companies and become investors in many others.

Venture capital firms became the connective tissue joining clusters of fortunate coworkers into an even larger network. One of the first firms to invest in PayPal was Sequoia Capital.

When it came to people an investor didn’t already know, reliance on personal attributes and a healthy dose of gut feeling led venture partners to bet on founders who seemed to share a lot of the same qualities as those who had succeeded before—in short, people like those already in their networks. “Pattern recognition” was how Kleiner Perkins partner John Doerr once put it. The most successful founders “all seem to be white, male nerds who’ve dropped out of Harvard or Stanford, and they absolutely have no social life”; when they showed up in his office, he said, he knew it was time to invest.

The remark was an unintended gaffe—don’t say the quiet part out loud!—but it was true. Doerr had risen up the ranks at Intel and took what he had learned in chipmaking to build one of the most successful venture careers in tech history. He funded and mentored Marc Andreessen of Netscape, Sergey Brin and Larry Page of Google, and Jeff Bezos of Amazon—all men.

Doerr and venture capitalists before and after him were eager to absorb new ideas, but their experiences had persuaded them that tech was a meritocracy and allowed them ignore the exclusion perpetuated by Silicon Valley’s tight-knit networks.

Money: “The Golden Geeks”

Hardware companies dominated both Silicon Valley and Boston through the 1970s. Software was rarely a stand-alone product but was bundled into a computer purchase or given away free. This helps explain why many women continued to hold programming jobs even as the field professionalized, rose in prestige, and came to be regarded by many corporations as an environment best suited for “antisocial, mathematically inclined males.”

When desktop computers first arrived on the market, some employers embraced programming as a job perfect for working mothers, who could plug in a modem and code from home between school pickups and household chores. That moment was short-lived, for the personal computer business also created the immensely profitable desktop software industry. Programming was no longer just for introverts and elementary school moms. It minted billionaires.

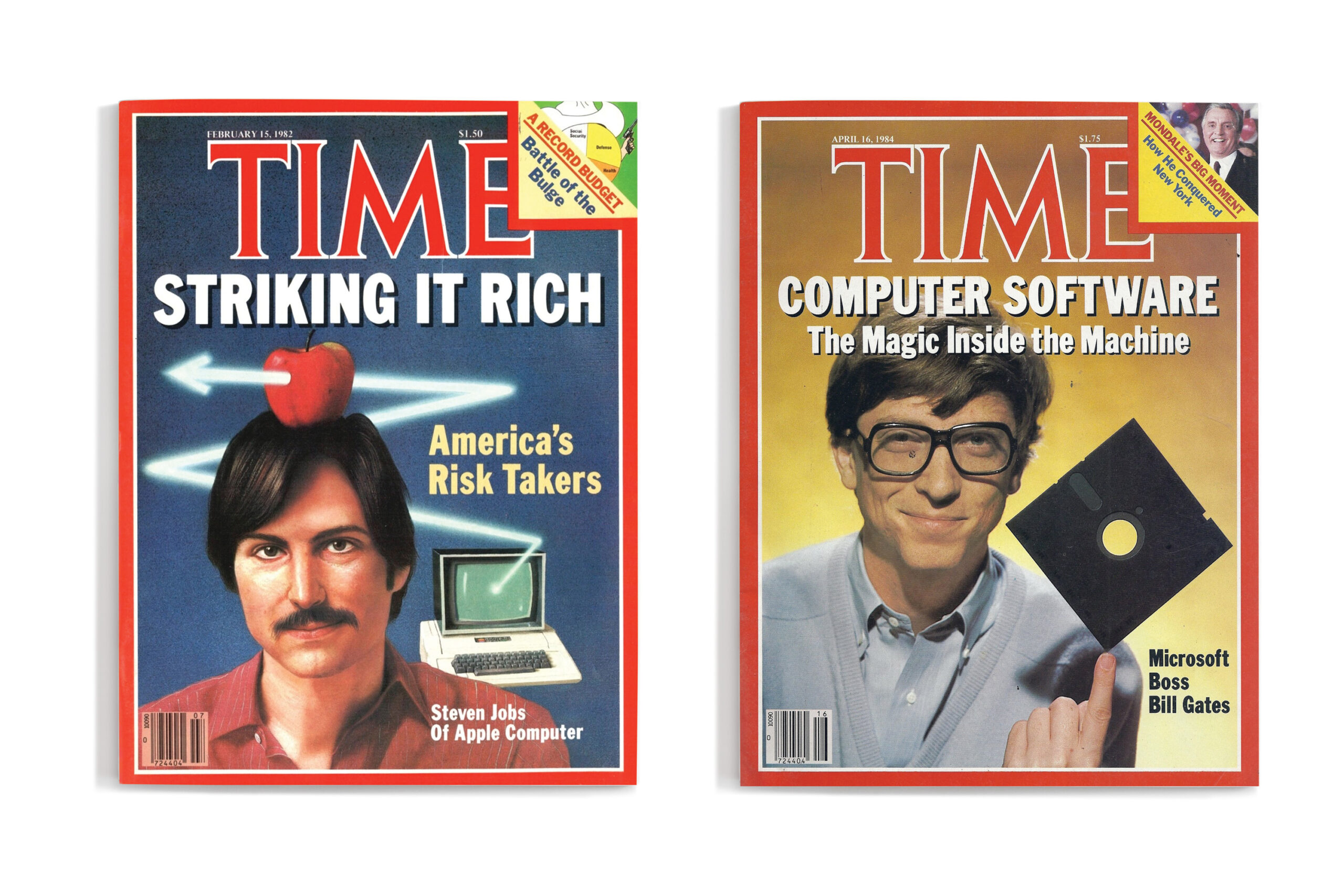

The colossus at the industry’s center was Microsoft, led by the most famous software geek of all, Bill Gates. By the late 1990s, the company’s products ran on over 90% of the personal computers on the planet. Gates was the world’s richest man and Valley venture capitalists were early-stage investors in his company. On Microsoft’s campus outside Seattle, armies of software engineers worked seven days a week. The workforce was so overwhelmingly male that one observer called it “the frat house from another planet.” Microsoft’s stock awards turned roughly 10,000 employees, mostly men and many under 30, into millionaires. Money ruled the 1980s, the 1990s, and beyond. “Striking It Rich,” read a 1982 Time headline hovering over a depiction of Apple’s Jobs on the magazine’s cover. Gates followed in 1984, twirling a floppy disk. In 1996, Time handed the crown to Netscape cofounder Andreessen. “The Golden Geeks,” the magazine crowed, picturing the 24-year-old multimillionaire hamming it up while sitting barefoot on a gilded throne.

Power: “I’m CEO … bitch”

After 2000, Silicon Valley was the undisputed high-tech capital, no longer just a place in California but shorthand for the industry itself. Founders of this new generation had a new set of mentors to learn from and admire. Jobs’s triumphant 1997 return to Apple after being forced out over a decade earlier had made him a business legend. His untimely death in 2011 further enshrined his legacy as the founder to emulate.

Andreessen was now a successful venture capitalist dispensing managerial wisdom over coffee and pancakes, just as an older generation had done for him decades before. “He became a sounding board about management and how to build a strong technology company,” recalled Mark Zuckerberg of the regular meetups he had with Andreessen in the early days of Facebook. “He has strong views on that, and they helped shape mine.”

The new generation of founders tended to be younger and brasher. Men who had spent their boyhoods staring into computer screens now had power, money, and swagger. A few months into Facebook’s existence, Zuckerberg realized he needed business cards. He ordered up two versions. One simply said “CEO.” The other: “I’m CEO … bitch!”

The workplace cultures of today’s large technology companies are as all-consuming as those of any early chipmaker. And the perks that firms showered on their white-collar employees pre-pandemic said a lot about the kinds of workers tech companies most valued. In 2017, Apple moved into an extraordinary new $5 billion headquarters witha two-story yoga room and seven cafes. Although it was designed to hold 12,000 employees, it did not have a child-care center.

Tech’s reckoning?

Today, the baton is passing to crypto enthusiasts and Web3 evangelists. While the cast of characters is slightly more diverse than it once was, the potential superstars of the next generation—Coinbase’s Brian Anderson and FTX’s Sam Bankman-Fried, to name two—remain mostly white and male.

Tech’s gender reckoning has been among a number of things fueling a new wave of employee activism. For the first time, Silicon Valley’s white-collar employees are speaking out publicly against their employers and, in some instances, successfully pressuring them for changes to corporate practices.

One striking thing about today’s activists, organizers, and whistleblowers is that nearly all of them are female, gender-nonconforming, or queer. Several are nonwhite. Outside and less beholden to tech’s charmed circles, they have been able to see tech’s problems more clearly. Women were six of the seven organizers of the 20,000-strong Google walkout in 2018, which protested the $90 million severance package awarded to top executive Andy Rubin after credible claims of sexual harassment. Computer scientist Timnit Gebru was recruited to Google because of her groundbreaking work on algorithmic bias and then was fired, reportedly because of the company’s discomfort with her findings. She has since become a powerful critic of Silicon Valley business and research practices. Data scientist Frances Haugen worked at Google, Yelp, and Pinterest before she came to Facebook, where alarm at the company’s business practices prompted her to copy thousands of pages of internal documents and leak them to reporters. (Haugen admitted that she was able to blow the whistle at Facebook because her tech career had made her wealthy enough to leave her job.)

Within companies, employee activism grows by the day. It is not only changing the culture but also—quite remarkably, given Silicon Valley’s history—fueling cross-class support for employee unionization. Women and gender-diverse employees are on the front lines of these movements as well.

The tech industry loves to talk about how it is changing the world. Yet retrograde, gendered patterns and habits have long fueled tech’s extraordinary moneymaking machine. Breaking out of them might ultimately be the most innovative move of all.

Historian Margaret O’Mara is the author of The Code: Silicon Valley and the Remaking of America.