This $1.5 billion startup promised to deliver clean fuels as cheap as gas. Experts are deeply skeptical.

Last summer, investors gathered in the parking lot of a converted warehouse in Santa Cruz, California.

Rob McGinnis, the founder and chief executive of Prometheus Fuels, was ready to show off his “Maxwell Core.” The pipe-shaped device is packed with a membrane riddled with carbon nanotubes, forming pores that separate alcohols from water.

That day, it was connected to a tank filled with both. As McGinnis explained how the technology worked, his staff used it to fill the tank of a Harley-Davidson motorcycle. The alcohol seeped through the membrane, concentrating it enough to power the vehicle, which had been converted to run on the fuel, he says.

Attendees were then invited to take the Harley for a spin.

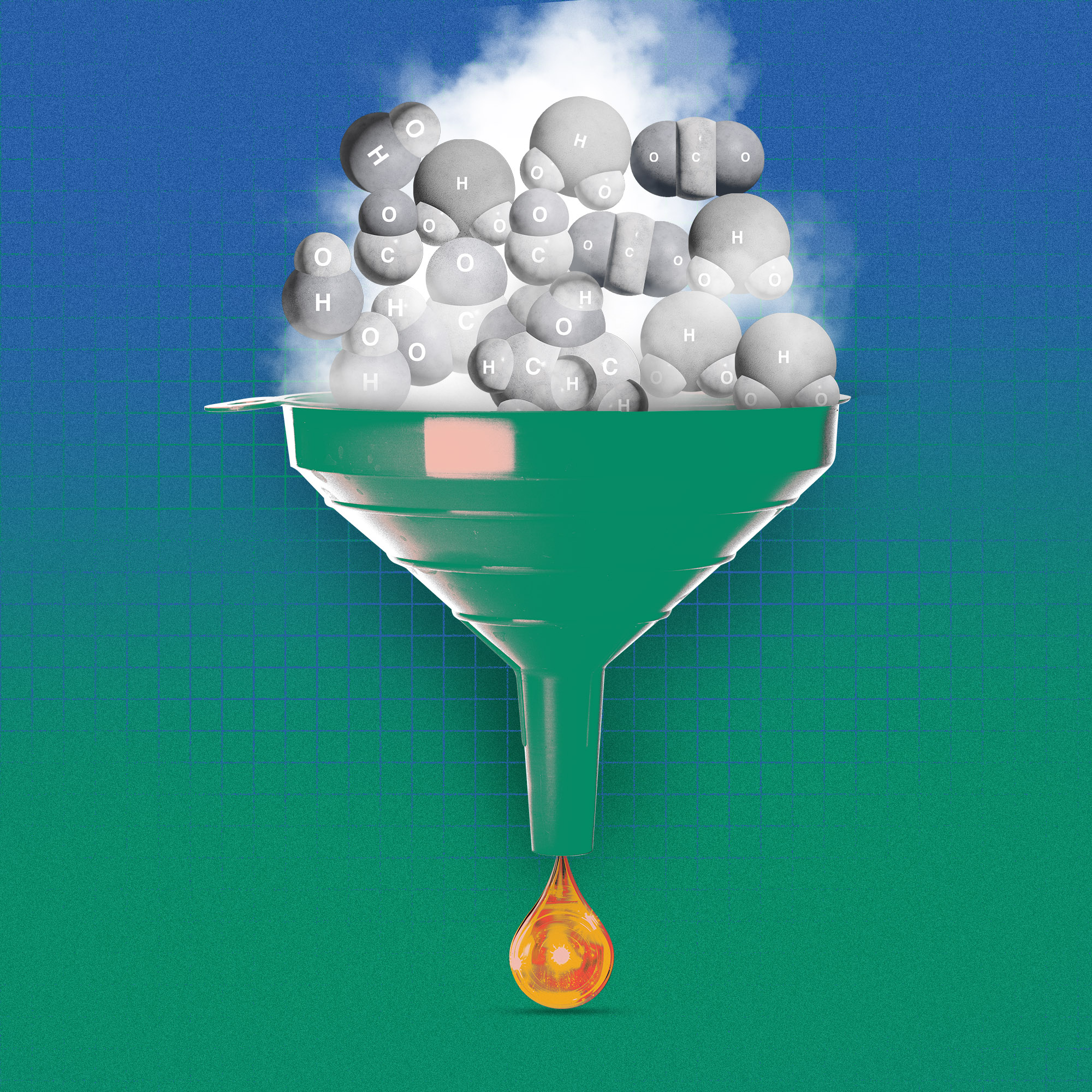

It was a theatrical demonstration of the technology key to McGinnis’s beguiling pitch: Prometheus will transform the global fuel sector by drawing greenhouse gas out of the air and converting it into carbon-neutral fuels that are as cheap as dirty, conventional ones.

Investors have thrown money at the company. Prometheus says it has raised more than $50 million from BMW’s investment arm, shipping giant Maersk, Y Combinator, and others. The startup has already struck deals to sell millions of gallons of its fuels to American Airlines and other aviation companies. It earned a shoutout in a Biden administration announcement detailing US efforts to shift toward sustainable aviation fuels. And after closing its venture round last September, the company announced that it was valued at more than $1.5 billion.

The only problem? There is little available evidence it can actually live up to its lofty claims.

McGinnis and his staff have built a prototype that combines the nanotube membrane with a device that sucks down carbon dioxide and a novel electrochemical cell. The system converts the captured carbon into alcohols and then concentrates them, avoiding what would otherwise be an expensive and energy-intensive distillation step as well as other costs.

A commercial-scale version would run on renewable power and add a final stage: converting those alcohols into synthetic forms of gasoline, diesel, and jet fuel. McGinnis has claimed that the resulting fuels will be “price competitive” with those derived from fossil fuels and won’t emit any more greenhouse gas than the process removes from the air.

The technology would look nothing like the huge refineries that the world depends on for its transportation fuels. They would be modular units that could be built anywhere, relatively cheaply. Last April, Prometheus announced it expects to have half a million of these plants operating by 2030. Those could collectively produce about 50 billion gallons of fuel per year and suck down nearly 7 billion tons of carbon dioxide by the end of the decade.

If these fuels could be produced at the costs and on the scales claimed, Prometheus might well overhaul the global energy marketplace. It would offer a simple way to neutralize the emissions of the cars and trucks already on the road, as well as the world’s fleets of ships and planes. And it would reduce the pressure to continue extracting fossil fuels and building oil refineries, easing the grip of petrostates and the world’s addiction to petroleum.

But Prometheus’s assertions have raised eyebrows among researchers, entrepreneurs, and venture capitalists. Several experts who have reviewed an investor presentation obtained by MIT Technology Review are dubious that the company can achieve the claimed costs.

“It’s laughable,” says Eric McFarland, a professor of chemical engineering at the University of California, Santa Barbara. “It’s the tech bubble again,” he added later. “People are putting money into lots of things that ultimately won’t ever work, and this is one of them.”

To support MIT Technology Review’s journalism, please consider becoming a subscriber.

Others are skeptical that a small startup has quietly integrated leading-edge chemistry, novel catalysts, and a breakthrough membrane into a single cost-effective package that will easily scale to commercial levels. They note that the company hasn’t publicly demonstrated a fully working system, submitted the process to peer review, or provided more detailed information on how it works, even to some potential investors.

The fact that the company widely missed its own targets for delivering synthetic fuels to the market has raised further doubts. McGinnis originally said that Prometheus would sell its alternative gas for $3 a gallon by sometime in 2020, undercutting fuel sold at the pump. Instead, two years later, the company has yet to piece together an integrated device that generates fuels that could power standard vehicles today.

All of this has created a perception among some that McGinnis, a theater major and playwright before he earned a doctorate in environmental engineering from Yale, is a bit of a showman. His bold claims have likely helped the company strike deals, observers say, but it’s made it harder to decipher the reality from the hype.

Most outside observers that MIT Technology Review spoke with still believe it could take decades before carbon-capturing factories can spit out fuels as cheaply as we can dig them up. Some think they never will.

Electrofuels

Prometheus, and some other startups working to produce fuels from captured carbon, describe the end product as “electrofuels,” since the process would effectively transform the energy in electricity into liquid fuels. The promise is that they could provide a missing piece in the climate puzzle: a carbon-neutral energy source for the entire transportation sector.

Batteries work fine for electric passenger vehicles, but it will still take decades to supplant all the world’s cars and trucks, and build out the necessary charging infrastructure. And no one expects batteries to power large ships and planes anytime soon.

It’s simply hard to beat the energy density and convenience of liquid hydrocarbon fuels. They’re cheap and they’re easy to ship, store, and combust, says Merritt Dailey, a researcher at the Center for Negative Carbon Emissions at Arizona State University.

Electrofuels offer a way to continue using such fuels, along with our existing infrastructure, without adding any more greenhouse gas than the process removes. The clearest path for producing these fuels is to build direct-air-capture plants that use sorbents or solvents to capture carbon dioxide. Separately, devices known as electrolyzers can split water to produce a clean form of hydrogen, which can then be reacted with the carbon to make hydrocarbons.

All that is straightforward chemistry, and it’s the path that one of Prometheus’s rivals, Carbon Engineering, is pursuing. In 2017, the company, based in British Columbia, added the ability to produce fuels from captured carbon onto its pilot plant in Squamish. In addition, it announced plans late last year to begin design work on a commercial plant near Merritt, BC, which could produce more than 25 million gallons of low-carbon versions of gasoline, diesel, and jet fuel per year.

But the problem is that direct-air-capture equipment and electrolyzers are both expensive to build and run. It requires considerable heat to separate the collected carbon dioxide from the sorbents and concentrate the gas; and it takes a lot of electricity to power the electrolyzers.

A study on electrofuels last year in Environmental Science & Technology found that with standard technologies, even at full commercial scale, a gasoline equivalent would cost around $16.80 a gallon. It estimated that costs might fall to about $6.40 in the next decade and $3.60 by 2050, but only if there are major cost reductions in the necessary equipment and electricity.

Given these costs, most observers believe that electrofuels won’t gain a foothold in the market without emissions mandates, steep carbon prices, or other supportive policies. Carbon Engineering, for instance, says it’s banking on government subsidies to make the economics work.

But Prometheus promises that its fuels will compete directly with those made from oil, largely because it’s avoiding key steps that make other electrofuels so expensive. What’s more, the company claims it won’t be decades before this happens, but just a few years.

Undercutting gasoline

In 2012, McGinnis left a desalination startup he cofounded, Oasys Water, but continued working on ways of improving a core piece of the technology: membranes.

He came to focus on the potential of carbon nanotubes, which can be designed to absorb or reject certain compounds. He spent years figuring out how to embed them into plastic sheets, aligning them perpendicular to the surface to create selective pores in the materials.

He coauthored a 2018 paper in Science Advances that showed he could manufacture carbon nanotube membranes that were effective at rejecting salt and magnesium sulfate. Additional refinements and experiments yielded nanotubes with openings just large enough to allow complex alcohol molecules through, while the interior tended to repel water. McGinnis became convinced he could use the technology to simplify a costly and complex step in one pathway for producing synthetic fuels.

In late 2018, McGinnis responded to Y Combinator’s call for carbon removal startups to apply to its accelerator program and got in, which he says marked the formation of Prometheus Fuels.

During YC’s Demo Day in San Francisco the following March, McGinnis reportedly stood on stage to deliver his pitch to the crowd of investors and show off a refrigerator-size prototype of the device he had completed days before the event.

It had sprung a leak and wasn’t operating, Science wrote at the time, but that didn’t prevent him from making a bold claim: “Today, gasoline sells for $3.50 a gallon in California. Next year, we will be selling it for $3 per gallon.”

The process

The process breaks down into four main stages, according to Prometheus’s investor materials.

In step one, industrial fans draw in air and blow it through a mix of water and other compounds, which McGinnis says could include sodium carbonate. That then readily reacts with carbon dioxide molecules in the air, shifting much of the carbonate to bicarbonate.

The resulting solution then moves into a battery-like cell with a membrane in the middle and electrodes on either end, which uses electricity to spark a series of chemical reactions that produce complex alcohols. It’s equipped with a catalyst based on technology licensed from Oak Ridge National Laboratory. In an earlier description, that lab said it had developed a catalyst made from tiny carbon spikes embedded with copper nanoparticles. When a voltage was applied, it converted carbon dioxide dissolved in water into ethanol “with a yield of 63%.”

Prometheus’s carbon nanotube membranes come into play in step three, separating the alcohols from the water.

And in a final step, different catalysts are used to combine the alcohols and convert them into synthetic gasoline, diesel, or jet fuel. In 2020, Prometheus licensed separate technology from the Oak Ridge lab that can be used to produce jet fuel from ethanol, through a multistep process that relies on a novel though unspecified catalyst.

The overall process is substantially different from the one other companies converting captured carbon into fuels are taking. As McGinnis explained in a Joule commentary, the Prometheus systems can operate under standard atmospheric pressure and at room temperature. The technology also avoids the heat energy needed to produce concentrated carbon dioxide as well as the capital costs of an electrolyzer dedicated to producing hydrogen. Instead, the company claims, it can synthesize alcohols straight from carbon dioxide dissolved in water, and then convert those into standard fuels.

If they’ve indeed figured out how to do this, it “could lead to significant energy and cost savings,” says Evan David Sherwin, a postdoctoral researcher at Stanford who produced the Environmental Science & Technology study.

One of the last slides in the investor materials shows a Prometheus-branded fuel station, with a red neon “Zero Net Carbon” sign advertising gas prices of $3.50 a gallon and diesel at $3.75, well below current average US prices.

‘Out over their skis’

McGinnis later pushed back his target date for delivering fuels, saying in that March 2020 Joule piece: “We project that by putting all of these advances together, it will be possible to offer renewable gasoline from [direct air capture] CO2-to-fuels within the next two years that is price competitive with fossil gasoline.”

When asked about that line, David Keith, a Harvard professor and founder of Carbon Engineering, mocked it in an email: “I project that by optimally putting all my smart ideas together it should be possible, within the next two years, for me to send a 5.13b climb [a very difficult rock-climbing grade] while getting elected to the National Academy and also launching an initiative that catalyzes global under-ocean [high-voltage, direct-current electric transmission line] interconnects.”

Both of Prometheus’s self-imposed deadlines have now passed.

McGinnis blames the delays on the pandemic and subsequent supply chain issues, and declines to state specifically when the company will be selling gas at the pump. “I feel like I got myself in trouble because I predicted things and then covid happened,” he says.

But he adds later that if “everything goes our way,” they could demonstrate the fuel later this year, and “maybe” begin shipping it commercially in 2023.

Other issues have also caught the eyes of outside observers.

The first is the solar cost Prometheus is banking on for its cost estimates: 2 cents per kilowatt-hour, which McGinnis says was based on the news that the city of Los Angeles had negotiated a contract to purchase renewable power for that amount.

But the Los Angeles figures reflected a 25-year contract with a giant customer that was able to secure rates not likely to be afforded to a single plant. The unsubsidized costs if you build and draw power straight from a large solar project in the sunniest parts of the US is around 3 cents per kilowatt-hour, says Ramez Naam, a clean energy investor focused on the solar sector, who is bullish on electrofuels. And costs go up from there if a plant is drawing on power from further away.

“I think they’re out over their skis a little bit,” he says, though adds that solar costs could reach the levels the company is projecting at some point in this decade.

Relying entirely on clean electricity, which is crucial to make the carbon-neutral math work, creates other constraints. To operate profitably while relying solely on solar or wind power, the plants themselves will need to be very cheap, highly automated and capable of flexibly ramping up and down as levels of electricity generation fluctuate. Or they’ll need to incorporate energy storage, like big battery banks, which would significantly increase costs. In some regions, the plants could also rely on steady sources of carbon-free power like nuclear, geothermal, or a mix of wind and solar resources that largely balance each other out.

When asked about the issues raised by variable renewable power, McGinnis said in an email that the fuel forges are designed to operate flexibly, quickly flipping on and off depending on availability and pricing of electricity. The facilities can also rely on hydrogen they generate as a byproduct to run the process in certain circumstances, he added.

Perhaps the biggest question is how well the various experimental parts of Prometheus’s system, particularly the electrochemical cells that produce alcohols, will work outside the lab.

Sean McCoy, an assistant professor in the department of chemical and petroleum engineering at the University of Calgary, says that academic groups have explored key parts of this process as well. But he adds it’s mostly early-stage research that has run into challenges, noting that others working on an electrochemical process for converting carbon dioxide to alcohol have produced “very low yields.”

“Is it technically possible to do it the way they propose? Yes,” he wrote in an email. “But, unless they have solved some major problems in the front end, they are probably many years from making this a commercial reality. Can they do it for a price that is competitive with fossil (without subsidies or carbon pricing … )? I doubt it.”

McFarland adds that it would be very expensive to bring about the extended series of reactions needed to generate complex alcohols, given the high cost of the electrochemical cells and the electricity required.

“Even if it costs them only 2 cents [per kilowatt-hour] then they won’t be able to compete with fossil fuels,” he said in an email.

In fact, some think it’s unlikely any company or process could ever produce synthetic fuels from direct air capture at equivalent costs, given the expensive hardware, the electricity requirements, and the ability of major oil-producing nations to drive down the cost of fossil fuels by opting to produce more oil.

“You can’t beat the free energy of the sun that went into the plants that formed fossil fuels to begin with,” McCoy says. “That’s the challenge.”

It’s also conspicuous to some that Breakthrough Energy Ventures, Carbon Direct and Lowercarbon Capital—three prominent venture capital firms with a reputation for scientific rigor and a focus on carbon removal—haven’t invested in the company. Venture sources say the final cost and technical claims seemed highly unlikely, and that McGinnis wouldn’t allow them to thoroughly vet certain scientific claims, which was seen as a red flag.

Stanford’s Sherwin says that the process “doesn’t seem crazy,” but he notes some of Prometheus’s cost and efficiency assumptions do appear “very aggressive.”

He raises another issue, noting that any company working on electrofuels will need to operate openly, or be subject to oversight, to be sure the end product is actually carbon neutral.

“It’s going to be really important for synthetic hydrocarbon manufacturers to have very transparent and clear verification of the source at every step,” he says. “Because it wouldn’t be hard at all to have a magic box and sell gasoline.”

‘Right around the corner’

In an emailed response to these issues, McGinnis said the company will use an impartial means of carbon-neutral certification when it’s available. He added that there will be additional ways of verifying how the fuels were produced, including through analysis of the carbon.

He stressed that the investor materials weren’t designed as a stand-alone document, noting they also provided some firms additional information on their process through a spoken pitch and other materials.

“Anyone who has only been able to read the pitch deck but did not receive it as part of a pitch will be missing important context,” he wrote, adding that skeptics that weren’t otherwise conflicted would be convinced “if they had access to our data, models and methods.”

McGinnis said the company has limited how much it shares about its process to protect intellectual property, including to venture firms that had invested in competing companies. He says he asked such firms to rely on technical due diligence the company had obtained from third party consultants.

McGinnis previously declined to discuss certain parts of the process in detail with MIT Technology Review as well, citing similar reasons.

“We’ve got some tricks that we filed patents for, and have some trade secrets on, that I’d love to share with you,” McGinnis says. “But we’re still in the process of finalizing some of the patents.”

But he suggests that Prometheus doesn’t face scientific challenges at this point, saying “there’s nothing between us and shipping fuel other than scaling.” Now that the company has raised its Series B funding round, he plans to hire quickly and move forward much faster.

McGinnis adds that they’ve already begun speaking with regulators about the steps they’d need to take to sell the fuel directly.

Prometheus’s investors also remain optimistic.

Marcus Behrendt, the chief executive at BMW i Ventures, the venture arm of the auto giant, says his group is “very confident” that Prometheus is on track and that its carbon-neutral fuels are “right around the corner.”

“If he is successful, this is going to be a really big game-changer—and the odds aren’t against him,” Behrendt says.

McGinnis says it’s always safe to be cynical and assume that startups will fail, because the vast majority of them do. But, he adds, then you’ll also miss that rare one that does deliver a genuine breakthrough.

“I understand people saying ‘I’ll believe it when I see it,’” he says. “That’s why it’s so beautiful that we don’t need anyone else’s permission to go to market. Because we either do ship fuel or we don’t.”