Subtotal: 63,40€ (incl. VAT)

The Merge is here: Ethereum has switched to proof of stake

“The Merge”, a major upgrade to the Ethereum cryptocurrency platform, was finally completed today after a six-year buildup. As of 2:43 ET this morning, Ethereum now uses proof of stake, a way to approve new transactions that promises to cut the blockchain’s energy requirements by 99.9% and usher in a new era for the second-largest cryptocurrency.

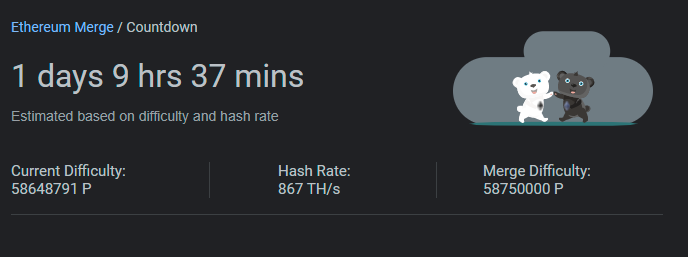

It would be hard to overstate how much industry excitement there has been around this shift. Many hope it can both rehabilitate the reputation of crypto for skeptics and improve the efficiency of Ethereum’s enormous ecosystem of businesses and developers. Google even created a countdown clock featuring white and black bears, a nod to a meme about the event.

Like Bitcoin, Ethereum had been approving new transactions on the blockchain with a consensus mechanism called proof of work, whereby “miners” race to solve hard math problems using huge amounts of computing power and are rewarded for their efforts in crypto. That approach consumes a lot of energy. It has also posed scaling challenges for Ethereum: network congestion drove up fees and slowed down processing rates, making the network too expensive for smaller transactions and hard to scale for larger ones.

Proof of stake, on the other hand, requires “validators” to put up a stake—a cache of ether tokens in this case—for a chance to be chosen to approve transactions and earn a small reward. The more a validator stakes, the greater the chance of winning the reward. But all staked ether will earn interest, which turns staking into something like buying shares or bonds without the computing overhead.

Decentralization––the idea that decision-making and control should be distributed rather than consolidated in a single authority—has always been key to Ethereum’s vision. But that ideal has been difficult to achieve with proof of work. Although the mechanism was intended to promote decentralization, in practice individuals or groups with access to significant computer power have dominated proof-of-work mining and reaped those benefits.

By reducing the required overhead for participation and cutting fees through efficiency improvements, switching to proof of stake could help Ethereum distribute transactions across a wider and more diverse set of validators and users. But power dynamics are still a concern. The minimum amount you can stake to become a validator is 32 ether (ETH), which is worth about $51,000 as of Wednesday afternoon, although individuals can join together in a staking pool to meet the requirement.

We won’t know right away whether the Merge—the moment when Ethereum’s main network joins with the layer that is using the new consensus mechanism—lives up to its transformative promise. Some of the scaling efficiencies that supporters are excited about won’t even arrive until after the Surge, Verge, Purge, and Splurge—other upgrades Ethereum CEO Vitalik Buterin has promised, which may continue well into 2023. In July, Buterin said he’d consider Ethereum only 55% “done” after the Merge.

In the meantime, a lot could happen. The price of ether, Ethereum’s cryptocurrency, could move up or down after the initial instability of speculation, and other proof-of-stake coins like Solana and Polkadot could be affected as well. The change could also put Ethereum in more of a regulatory gray area. Some legal scholars have suggested that using proof of stake puts the cryptocurrency at greater risk of being classified as an unregistered security because the fact that validators work alongside one another to approve transactions with the expectation of reward could be viewed as a “common enterprise”; other experts doubt that the argument is strong enough for the SEC to pursue. Buterin has claimed that the Merge makes Ethereum’s network more secure, but some experts have suggested that the opposite is the case, cautioning users to watch out for “replay attacks” where scammers can record a transaction on Ethereum’s old chain and repeat it without permission on the new one.

Because transactions on the network post-Merge should look more like other financial transactions, traditional businesses that may have shied away from crypto’s unique and energy-guzzling processes might take a second look at Ethereum—and proof-of-stake cryptocurrencies in general. If they do, the crypto industry could see a makeover in its reputation and user base.

On the other side of the coin, startups built around miners, who have been cut out of Ethereum’s process, will likely need to pivot or refocus on Bitcoin and other proof-of-work networks. Some die-hard Ethereum 1 proponents plan to stick with proof-of-work Ethereum. One popular miner has said he’ll “hard fork” the network, splitting off the code to preserve a separate chain (as some did in 2016 to preserve a previous incarnation of Ethereum). That move isn’t likely to have a large impact on the ecosystem unless the big platforms recognize it; OpenSea, the largest marketplace for NFTs, has claimed it will only support proof-of-stake Ethereum.

Regardless of what happens next, Ethereum’s much-anticipated shift to proof of stake has injected a boost of new enthusiasm and technical possibility into an industry beaten down by constant reports of fraud and legal investigations, plummeting token prices, and public exhaustion with celebrity endorsements and hype cycles. The fact that one of the major crypto players invested time and money laying the groundwork for a less destructive and more efficient ecosystem is an enormous achievement. That signal alone may prove transformative for the Web3 industry, which is still getting steady VC investment and could find new fuel in buoyed public perception.

Rebecca Ackermann is a writer, designer, and artist based in San Francisco. She wrote about the promises of crypto and Web3 for MIT Technology Review’s Money Issue earlier this year.