The future of urban housing is energy-efficient refrigerators

The scars and pockmarks of the aging apartments and housing units under the purview of the New York City Housing Authority don’t immediately communicate the idea of innovation. The largest landlord in the city, housing nearly 1 in 16 New Yorkers, NYCHA has seen its buildings literally crumble after decades of deferred maintenance and poor stewardship.

Just as the physical infrastructure has broken down, leading to busted elevators, picked-apart playgrounds, and crumbling façades, the agency has weathered a series of scandals in recent years over mold infestations and faked lead inspections. Hurricane Sandy in 2012 just added to the toll, flooding electrical and heating systems located in building basements. All told, this forsaken subsidized housing is in the midst of what local planners have called “demolition by neglect.” It would require an estimated $40 billion or more, at least $180,000 per unit, to return the buildings to a state of good repair.

Years ago, there was evidence of innovation hidden inside these units—in the kitchens. By the late ’90s, NYCHA realized that the existing fridges in many units were basically “gas guzzlers”—hugely inefficient, aging, and costly to the agency, which pays tenants’ electricity bills. In a collaboration with the local utility, NYCHA held a contest for appliance manufacturers, asking them to create smaller, apartment-size units with superior efficiency; the winner would gain access to NYCHA and a cadre of other housing authorities interested in a purchase plan of at least 20,000 annually. Maytag won, with its then-novel Magic Chef model, which helped NYCHA cut costs by increasing energy efficiency—and also slashed emissions. Ultimately, 150,000 of the fridges were purchased between 1995 and 2003. It was a model of using the agency’s heft and market power to drive innovation.

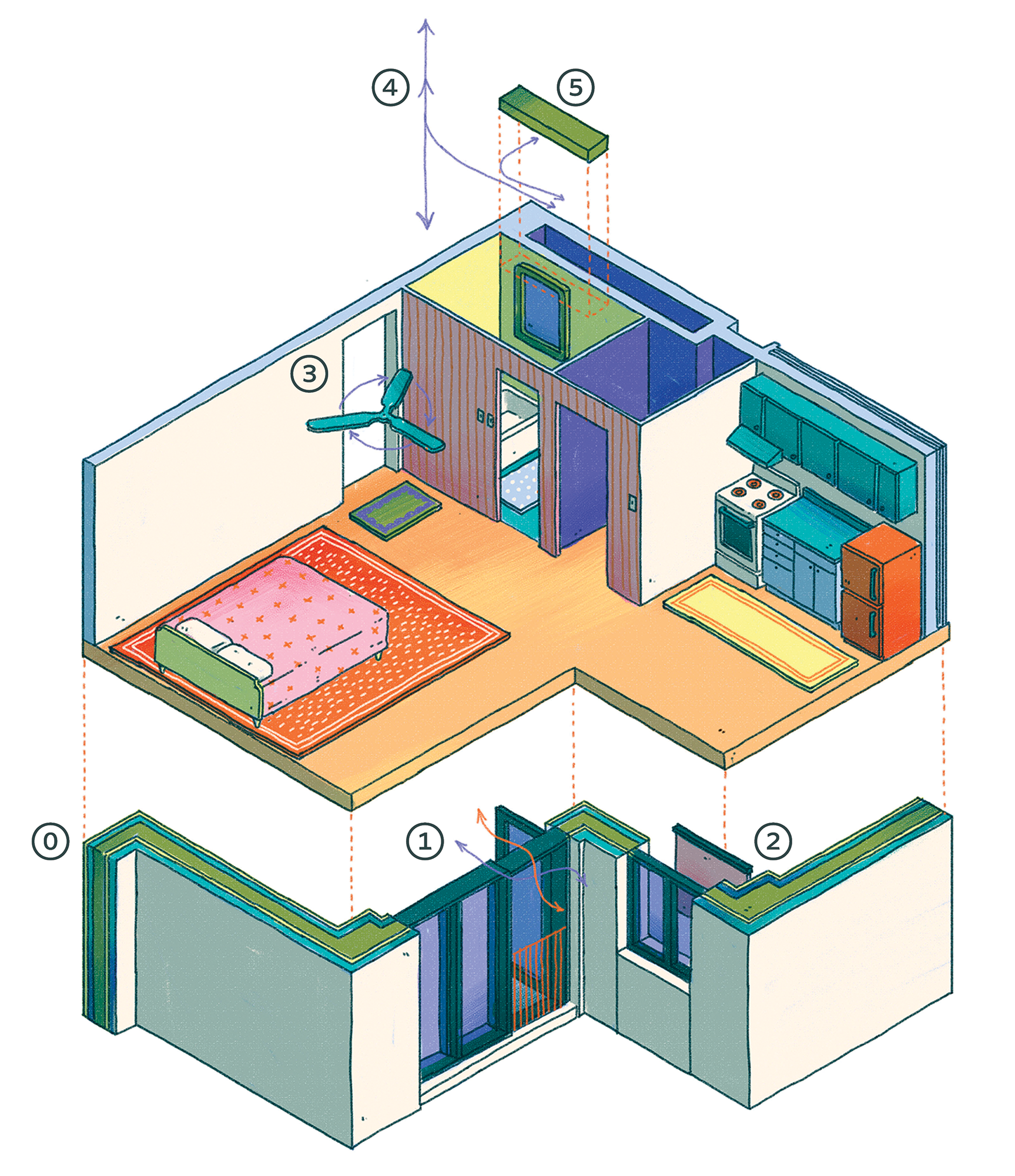

Now NYCHA wants to do the same with heating and cooling. The Clean Heat for All Challenge is asking manufacturers to develop low-cost, easy-to-install heat-pump technologies for building retrofits. The proposed devices, which would need to fit within a standard window frame, would replace the ubiquitous window AC unit and efficiently heat and cool an apartment without using refrigerants or directly burning fossil fuels.

The agency is backing up the contest with a commitment to purchase and install at least 24,000 units of whatever model wins, part of a $250 million capital plan; meanwhile the New York State Energy Research and Development Authority, or NYSERDA, is helping recruit other housing agencies across the state and nation to sign on and promise to buy new units. “We expect to utilize this mechanism again and again next time we have to meet a massive market demand,” says Emily Dean, NYSERDA’s director of housing decarbonization.

The stakes for the agency, for the winning company, and for society itself could be huge. Investing in more-efficient heating and cooling in buildings is good for people and the planet; finding an equitable way to do so at the scales and speed needed to meet the climate challenge would be transformative.

“Eight million people a year buy window AC in the US, the HVAC industry is $100 billion a year globally, and the number of AC units on the planet will triple by 2050—mostly small, room-sized units like what we’re trying to push forward,” explains Vincent Romanin, an engineer and the CEO of Gradient, one of the startups that submitted a design for the NYCHA challenge. “This is a huge market signal that can speed up the approach of these technologies.”

That’s not the only technological leap NYCHA and NYSERDA hope to make in coming years. RetrofitNY, a $30 million pilot program, seeks to support a new kind of whole-building energy retrofit that would basically attach airtight, weatherproof panels to the exteriors of older buildings—a technique invented and implemented in the Netherlands by a nonprofit called Energiesprong, which means “energy leap.” Not only would this high-tech cocoon dramatically slash energy usage, but it could be put in place without asking residents to leave. The first test project set to be completed, Casa Pasiva in Brooklyn, should fully open in October, after a pandemic-era delay.

“Doing these kinds of retrofits across our portfolio seemed infeasible a few years ago,” says Ryan Cassidy, director of sustainability and construction at RiseBoro Community Partnership, the nonprofit developer backing the Casa Pasiva project. “It may cost a little extra, but we have the means and methods right now.”

Historically, the only innovation many felt was needed for aging housing stock was demolition and new “green” construction. But it’s far more sustainable to retrofit existing buildings than to tear them down and build new ones. The climate crisis has created a fierce urgency around cutting carbon emissions, and any serious plan to do so needs to sink substantial money into adapting old, energy-inefficient housing. Bringing out the wrecking ball simply exacts too high a cost in both dollars and carbon.

Buildings, especially the aging and inefficient, account for nearly 40% of the nation’s energy usage. More than half the country’s available rental units are more than half a century old, and the Department of Energy estimates that 75% of the 130 million buildings in the US will be standing in 2050. Retrofits and upgrades aren’t happening fast enough; currently, the DOE believes, 2.3 million homes get upgraded each year. Roughly 3 to 6 million annually would need to be retrofitted to meet emissions targets. That means the nation’s developers and property owners need immediate, tested, efficient, and affordable solutions—and the financing and political will to fund them.

“Many of the solutions we need to decarbonize mass-market buildings already exist, and we’re trying to support the ideas that can scale at speed,” says Thatcher Bell, program director at The Clean Fight, an incubator for clean-energy startups that focuses on moresustainable housing solutions. “Innovation is difficult, but adoption is more difficult.”

Housing requires a great mobilization to meet this massive challenge. But so far, traditional tech disruptors haven’t had the kind of success in this sector that they’ve seen in other industries. Katerra, a SoftBank-backed Silicon Valley housing startup that bragged it had radically reworked the building process, flamed out after raising $3 billion, a potent symbol of the struggles that have plagued startups in an industry that must contend with so many moving parts—labor, local regulations, supply chain issues, building codes. Social Construct, a startup birthed at the influential Y Combinator in San Francisco, attempted to streamline multifamily construction with automation and AI, but it filed for bankruptcy last year, citing pandemic pressures.

Programs that are beginning to move the needle on climate action—NYCHA’s efforts, more-advanced public-focused models in Canada and Europe, and local incentive programs like a heat pump push in Maine or the wildly successful TECH Initiative, a $120 million program designed to help advance California’s mission to achieve carbon neutrality by 2045—suggest that the Silicon Valley model of innovation may not work against one of the planet’s most important problems. It’s not exactly an issue of public versus private, but patient capital and policy-focused interventions can bring more equity, and perhaps quicker emissions cuts, than moving fast and breaking things. As Cassidy says of the Casa Pasiva project, there’s no cool technology filled with buttons and controllers that residents can push; it’s smart insulation and air sealing, “not something you’re selling to venture capital.”

“One part of the market is looking to provide long-term, affordable, sustainable housing, versus one that’s profit driven, which doesn’t lend itself to more long-term consideration of housing stock,” says Yu Ann Tan, an associate with the carbon-free-building team at RMI, a think tank focused on clean energy. “Time is of the essence. Housing authorities can’t wait for a huge, silver-bullet tech solution or a huge pot of money that may not materialize.”

For much of the last century, one constant in housing and construction technology was the vision of making things more machine-like and automated. The idea was to introduce factory precision via prefabricated or modular construction, done primarily in a controlled environment rather than at a messy construction site. This would result in replicable, kit-of-parts models as interchangeable and easy to assemble as Lego bricks. Even Frank Lloyd Wright spent years tweaking and testing his own American System-Built prefabricated homes. Thomas Edison had a similar idea.

But Katerra, a hypergrowth startup, envisioned something grander: a series of factories across the nation, churning out assemblies and premade parts. At one point, the firm had hundreds of projects booked and had expanded into mass timber construction and even making its own light bulbs: it was a vertically integrated firm building vertically. Cofounders Michael Marks and Fritz Wolff thought they would bring their experience in tech supply chains and manufacturing to a new industry. Instead, Katerra—once valued at $6 billion—declared bankruptcy last summer.

“They had hubris and disdain for the industry, and no real vision for what their model would be,” says Michelle Knapp, a construction specialist and cofounder of FunForm, a startup focused on building retrofits. “They were using technology to build an Edsel. If you’re using robots to build an Edsel, you’re still building an Edsel.”

Katerra’s all-encompassing vision of reforming the construction world, using billions of dollars in investment to build an entirely new production system from the ground up, showcased stereotypical Silicon Valley arrogance. It also has had a fraction of the impact of European models that seek to retrofit using a simple, straightforward, and standard set of parts.

The company shared a common blind spot with many American technologists, according to Gerard McCaughey, a serial entrepreneur and founder of Century Homes, an Irish pioneer of off-site construction: it disregarded innovation pioneered overseas. While American construction favored wood-frame building on-site with readily available raw materials—picture a Ford pickup piled with two-by-fours pulling up to a lot—more space- and material-constrained builders in Asia and Europe have perfected prefab and modular techniques. Katerra ignored these examples, which slowly built up expertise by focusing on specific sectors one at a time. Instead, it tried to reinvent the wheel, bringing every facet of the complex construction process in-house and building too many different models at once and causing massive cost overruns.

“It’s not what you know or what you don’t know that catches you,” says McCaughey, who held talks with Katerra leaders. “There were things they were dead certain you needed to do, but [they were wrong]. Off-site isn’t a one-trick pony. You have to crawl before you can walk. The least experienced guy in my company knew more about off-site construction than their senior leadership.”

Many efforts are underway to decarbonize buildings. An example is the Holistic Energy and Architectural Retrofit Toolkit (HEART), a cloud-based computing platform that includes decision-making and energy management features.

The Energiesprong model, which has retrofitted thousands of homes in the Netherlands and across Europe, relies on Stroomversnelling (the name means “rapid acceleration”), a network in which contractors, housing associations, parts suppliers, and even financiers work in close contact—a level of coordination that even Katerra’s sprawling system didn’t match. Right now, the Energiesprong system can redo a building in roughly 10 days. Other startups and construction companies offer complimentary upgrades: Dutch firm Factory Zero, for example, makes prebuilt modules for roofs boasting electric boilers, heat pumps, and solar hookups. The greening of an older building is nearly plug-and-play.

It’s part of a larger European model that starts with an ambitious emissions policy and supports it with incentives and funding for retrofits and new buildings via programs like Horizon Europe, in effect subsidizing novel building methods and creating a market for innovative windows, doors, and HVAC systems. A key component of its success has been governments’ willingness to fund such upgrades for subsidized and public housing, typically postwar towers and townhomes in desperate need of improvement. But there are also other significant advantages in Europe: building codes are much more standardized across countries and the continent as a whole, including some progressive regulations pushing for the passivhaus standard, an ultra-efficient level of insulation and ventilation that drastically reduces the energy needed for heating and cooling. The entire housing ecosystem is smaller and more standardized too, making it easier to support more experiments. Energiesprong uses a single building model, a handful of contractors, and a relatively small pool of players across a small area.

Coordination would be exponentially harder in a single US city, much less the entire nation. “Europe takes a shotgun approach and funds numerous programs across the board,” says Michael Eliason, a Seattle-based sustainable building expert and founder of Larch Lab, a design studio and think tank. It’s an approach that spreads risk among different ideas, as opposed to concentrating venture capital on a handful of single-minded hypergrowth startups. “The US ends up being kind of a sniper rifle,” he says. “Katerra fails and it impacts the entire prefab construction industry.”

An emerging model in Canada seeks to replicate Europe’s. CityHousing Hamilton, the municipal housing authority for the Ontario city, recently used national housing funds for a full retrofit of Ken Soble Tower, a waterfront high-rise for seniors that was built in 1967 and had fallen into disrepair. The project, which incorporated panelized exterior cladding, new high-efficiency windows, and electrification of heating and gas stoves, brought the building to the passivhaus standard; with a 94% reduction in energy usage thanks to extreme efficiency, the total energy needed to cool and heat a unit is equivalent to three incandescent light bulbs. Gracious new bay windows offering seating, sweeping views, and daylight suggest there was no aesthetic price to pay.

Graeme Stewart of ERA Architects, who led the project and has studied the nation’s hundreds of similar midcentury high-rises, says the project gave business to Canadian firms manufacturing high-tech windows and cladding, suggesting that such work could help seed a domestic industry for more green building projects. He’s even spearheaded creation of the Tower Renewal Partnership, an organization dedicated to pursuing similar retrofits across Canada. But CityHousing Hamilton’s development manager, Sean Botham, says that even with all the benefits they’re seeing for the tower residents—better air quality, infection control, mental health, and cognitive function, and “views you just don’t get in social housing”—the agency isn’t likely to pay the 8% cost premium to upgrade other buildings in its portfolio without more funding support.

“The European version of this kind of building isn’t a story anymore; it’s just gravity,” says Stewart. “Every jurisdiction has their own way to do this. In North America, high performance is a tax. How does this become a continent-wide imperative?”

“We’re operating off a ‘nice to have’ energy-efficiency perspective rather than a climate change perspective—the ‘house on fire, we need wartime levels of funding for homes’ perspective.”

Panama Bartholomy

At least in the United States, any progress seems destined to be decentralized for the foreseeable future. President Joe Biden’s Build Back Better plan includes ambitious proposals to invest billions of dollars in retrofits, but the prospects of passing these proposals, even in piecemeal fashion, are dim, though the provision of $5 billion for weatherization in the infrastructure bill the Senate passed in November 2021 will make an impact, says RMI’s Tan. Some scattered private firms are retrofitting their assets: RENU, a program with Taurus Investment Holdings, a global private-equity real estate investor, conducts energy retrofit audits when acquiring new buildings in its portfolio, seeing heat pumps and energy-efficient upgrades as a way to increase asset value and reduce maintenance costs. But it’s an exception, and more urgency is needed.

“We’re operating off the old paradigm of buildings—a ‘nice to have’ energy-efficiency perspective—rather than the climate change perspective, the ‘house on fire, we need wartime levels of funding for homes’ perspective,” says Panama Bartholomy, founder and executive director of the Building Decarbonization Coalition.

But since building codes and incentives tend to be the purview of state and municipal governments in the US, experiments like the ones NYCHA and NYSERDA are embarking on become even more important. New York City’s Local Law 97, one of a handful of city laws that set aggressive emissions targets for big-building owners and substantial fines if they don’t comply, takes effect in 2024.

There are myriad challenges to making the panelized-retrofit solution work in the United States and reforming the way that housing innovation is funded and funneled throughout the entire built environment. Importing a concept from a country that’s so different in its building typologies, economic incentives, and construction culture has challenges all on its own, says Knapp, who worked on an early RetrofitNY project.

According to a NYCHA spokesperson, the agency’s decarbonization efforts are stymied by issues including the age of buildings, the need for electrical upgrades, and the lack of cost and performance data on panelized options. Nevertheless, NYCHA is already testing heat pumps at Fort Independence, as well as induction stoves at 1471 Watson Avenue (both in the Bronx), in anticipation of wider adoption. And the first RetrofitNY project tackling a NYCHA building, the Ravenswood Building in Queens, is scheduled to finish converting the six-story, 48-unit building by March 2024.

“We’re seeing lots of interest in the supply side of the market, and the business model is shifting,” says NYSERDA’s Dean. “We’re seeing the creation of a new class of solution providers, providing turnkey carbon-neutral retrofits for buildings with a performance guarantee and greater price guarantees.”

The real question is whether efficiency gained through innovation, ambitious policies, and supportive funding can all come together in time to really make a dent in current retrofit efforts. Tan says some researchers have even looked at how to channel health-care dollars into such renovations, because improved air quality and mold reduction have such a profound impact on residents’ health.

She points to a particular program, Philadelphia’s Built to Last, as a good template for the way many of these projects could be funded in the future. A project of the Philadelphia Energy Authority, the program looks at the world of incentives that low-income homeowners could tap into to retrofit and repair, from weatherization benefits to efficient-appliance rebates. Alon Abramson, the program’s director, says the program, which was delayed by the pandemic, is now working on 25 different homes, coordinating contractors, requirements, and project timelines to help restore housing that’s often severely dilapidated.

For people living in the houses now being renovated, it wasn’t uncommon to lose access to heat or to a working oven, or have plumbing pipes crack so that running water was unavailable. They often faced huge energy bills because of poor insulation, cheap materials, and deferred maintenance, Abramson says. His experience just underscores the extent to which energy costs, both financial and environmental, place a burden on those with the least. It’s a problem that has no easy fixes.

“We need to decarbonize our housing stock, but the systemic problems are pretty profound,” says Abramson. “It’s a technology problem to get heat pumps in these homes. That’s a fundamental problem. But missing windows are a bigger issue.”