Open finance heralds a new era

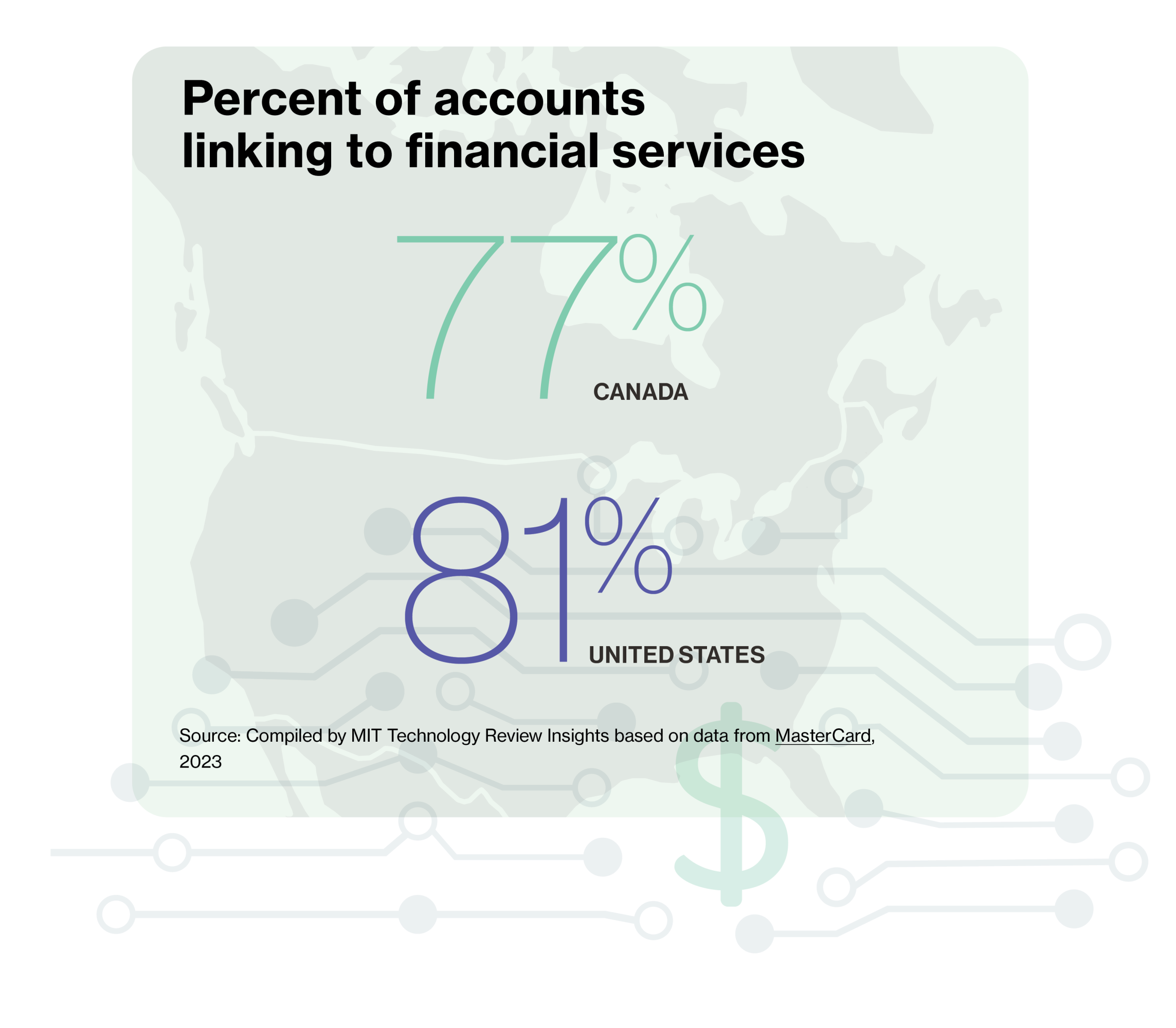

Open banking, which allows consumers to securely share their banking data with third-party providers (TPPs), continues to transform financial services. A new generation of financial technology (fintech) companies—peer-to-peer payment services, mobile banking apps, and trading platforms—offer consumers powerful tools to manage their money and extend their banking capabilities. According to the online data platform Statista, the worldwide number of consumers using open banking services is projected to reach 132.2 million by 2024.

With open finance, the next iteration of open banking, consumers can control and share their financial information securely with TPPs or financial institutions, accessing an array of financial services including digital banking, lending, payments, renting property, and investing. For consumers the services promise fairness, new products, safety, transparency, convenience, and choice—the ability to control and manage their own data for their own benefit. To deliver, open finance requires strong guardrails for cybersecurity, regulations, and education to ensure consumers can make sound financial decisions.

Inclusive financial services

For many, access to financial services like credit is essential for autonomy and economic freedom. However, the credit system’s rigid categories and controls leave out some consumers. According to a TransUnion 2022 global study, 8.1 million people in the U.S. (3% of adults) are considered credit unserved, and another 37 million are considered credit underserved (14% of adults); in Canada, 9.6 million people are either credit unserved or underserved, more than 30% of adults.

Systems that evaluate consumer data can be fraught with biases. In the UK, the Financial Conduct Authority (FCA) found individual credit information is significantly different across its three large credit reference agencies (CRAs). It reports relatively low understanding about credit among consumers, and found it is difficult to access credit information, or to raise disputes.

Similarly, a 2015 U.S. Consumer Financial Protection Bureau (CFPB) study looked at “credit invisibles” —individuals with no credit or a limited credit history who are less likely to be approved for loans based on the data provided by the three nationwide credit reporting agencies (NCRAs). The CFPB concludes this bias disproportionately affects Black and Hispanic financial consumers.

Immigrants encounter bias in credit score calculations as well. Raja Chakravorti, universal access lead at financial services company Plaid, says Fair Isaac Corp-oration (FICO) score calculations do not consistently pull data properly across borders, something he hopes open finance can help fix. “One of the hopes and advantages of open banking or open finance is that we are creating more of that positive trajectory, and over time, financial services would become more inclusive,” he says.

Chakravorti says traditional credit bureau data is not the only way to find out whether a consumer is a good financial risk. Alternate data—such as investments, loans, utility payments, and subscription payments—can show a person’s financial behavior and also indicate financial health, he says. How a consumer manages personal finances, like paying bills on time and consistently, can show how likely they are to meet financial responsibilities, he says.

This content was produced by Insights, the custom content arm of MIT Technology Review. It was not written by MIT Technology Review’s editorial staff.