New business models, big opportunity: Tech/manufacturing

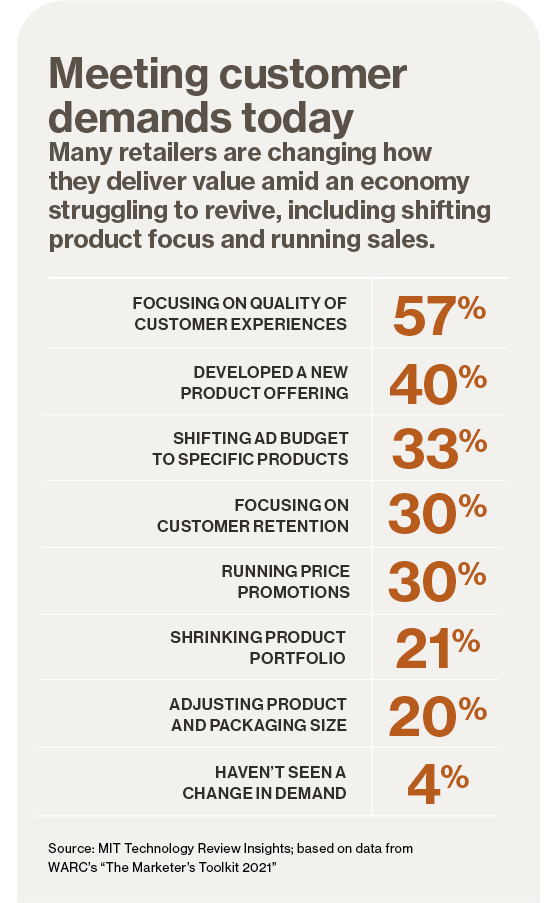

The 2020 coronavirus pandemic upended the way companies do business. Some are coping better than others—but largely, businesses are optimistic about 2021.

That’s especially so for tech-forward organizations in two different industries—technology and manufacturing— that are planning major business initiatives to move beyond crisis response and thrive in a transformed corporate landscape. The pandemic accelerated trends that already were underway—and while 2020 might have been spent coping with the crisis, many business leaders are thinking about the next steps.

“We are in the middle of probably one of the biggest strategic moves the company has made in its history,” says Ritu Raj, director for enterprise engineering at John Deere. “That’s a big statement for a company that’s over 180 years old.”

According to a worldwide survey of 297 executives, conducted by MIT Technology Review Insights, in association with Oracle, 80% feel upbeat about their organizations’ ultimate goals for 2021, expecting to thrive—for example, sell more products and services—or transform—change business models, sales methodology, or otherwise do things differently.

The iconic manufacturer of agricultural and construction equipment is building a new operating model for the company with technology as the centerpiece, Raj says. For example, the tractors it’s selling today collect data about their operations and help farmers complete jobs like planting with precision. It’s one of the big moves— new business models, mergers and acquisitions, and big technology changes such as widespread automation— that organizations are making or planning in a landscape transformed by the pandemic.

A tale of two industries

Every industry has unique characteristics. Certainly that’s true of technology companies, which by their nature undergo rapid transformation. The industry tends to be early adopters of new technology, says Mike Saslavsky, senior director of high-tech industry strategy at Oracle. Most tech products have rapid, short lifecycles: “You have to stay up with the next generation of technology,” he adds. “If you’re not transforming and evolving your business, then you’re probably going to be out of the market.” That premise applies across the range of businesses categorized as “tech,” from chip manufacturers to consumer devices to office equipment such as copiers.

Manufacturing has traditionally maintained a more complicated relationship with technology. On the one hand, the industry is trying to be resilient and flexible in a volatile present, says John Barcus, group vice president of Oracle’s industry strategy group. Geopolitical issues like protectionism make it harder to get the right materials delivered for products, and the lockdowns imposed during the pandemic have caused further supply chain issues. That has led manufacturers to greater adoption of cloud technologies to connect partners, track goods, and streamline processes.

On the other hand, the industry has a reputation for short-term thinking—“If it works OK today, I can wait until tomorrow to fix it,” says Barcus. That shortsightedness is caused, often understandably, by cash-flow problems and risk associated with tech investment. “And then, all of a sudden something new hits that they weren’t prepared for and they have to react.”

There are shining examples of what manufacturers could be doing. For instance, global auto parts maker Aptiv spun off its powertrain business in 2017 to focus on high-growth areas such as advanced safety technology, connected services, and autonomous driving, says David Liu, who was until January 2020 director of corporate strategy. (He’s now director of corporate development at General Motors.) In 2019, Aptiv formed Motional, a $4 billion autonomous driving joint venture with Hyundai to accelerate the development and commercialization of autonomous vehicles. The pandemic forced the company to have both the financial discipline to withstand an unpredictable “black swan” event and the imagination and drive to do big things, Liu says. In June 2020, for example, the company made a $4 billion equity issuance to shore up its future growth through investments and possible acquisitions. “The key for us is to balance operational focus and long-term strategic thinking.”

The drive behind the plans

Among all survey respondents, the most common planned big moves are substantially increased technology investments (60%) and cloud migrations (46%), with more than a third acting on business-merger plans.

In the technology and manufacturing industries, there’s more commitment to digitize business, and the organizations that did so before the pandemic were better prepared to cope. For instance, they had the technology in place to allow their workforces to work from home, Barcus points out. In fact, the crisis accelerated those efforts. Whatever their progress, he says, “Many of them, if not most of them, are now looking at, ‘How do I prepare and thrive in this new environment?’”

Download the full report.

This content was produced by Insights, the custom content arm of MIT Technology Review. It was not written by MIT Technology Review’s editorial staff.